6.2. Without prejudice to Clause 6.1 hereof, AEON Credit shall not be responsible for the refusal of any merchant or member institution of VISA International to honour or accept the Card or for any defect or deficiency in the goods or services supplied to the Cardholder by any merchant. Any complaint by the Cardholder must be resolved directly with the merchant or member institution of VISA International concerned and no claim against the merchant or member institution of VISA International shall entitle the Cardholder to set off for counterclaim against AEON Credit or to withhold payment to AEON Credit on account of any such complaint or under any circumstances whatsoever.

7. PIN AND USE OF THE CARD WHERE APPLICABLE

7.1. AEON Credit will provide a Temporary PIN to the Cardholder via PIN Mailer upon collection of the welcome kit with Card.

7.2. The Cardholder, upon receipt of the Temporary PIN shall change the Temporary PIN at any of AEON Credit ATMs or the Cardholder may perform the PIN change during collection of the Card.

7.3. Alternatively, the Cardholder may log - in to AEON Credit website and follow the instruction on the PIN changes option.

7.4. If the Cardholder has forgotten his or her PIN, AEON Credit will issue the Cardholder with a new Temporary PIN upon the Cardholder’s request.

7.5. For security reasons, the Cardholder is advised to change PIN at regular intervals (e.g. every Two (2) years).

7.6. In the event of lost or stolen Card as reported by the Cardholder, whereby AEON Credit agrees to issue the Cardholder with a new Card, a Temporary PIN for the new Card will also be issued. The Cardholder is not able to use the existing PIN with a replacement Card.

8. PIN & PAY CARDHOLDER SAFETY TIPS

8.1. The Cardholder must take all reasonable precautions to prevent the Card and the Card number, the PIN, the password, any internet password and internet Identity number or any other security details for the Card or Account (the Card Security Details) from being misused or being used to commit fraud. These precautions include:

· Sign the Card as soon as it is received and comply with any security instructions;

· Destroy any notification of the PIN and of any Card security details;

· Do not allow another person to view your PIN when you enter it into your account or point – of - sale device or display your PIN by any means to any person to avoid any unauthorized

Use;

· Do not tamper with the Card;

· Regularly check that you still have your Card;

· Ensure that the transaction amount is correct before you sign any vouchers or transaction records given to you by merchants or financial institutions, or when tapping your Card at a Contactless Terminal and before you enter your PIN at Electronic Banking Terminals;

· Keep Card receipts securely and dispose of them carefully;

· Remember to retrieve your Card after you use it; and

· Contact us immediately at 03-2719 9999 about any suspicious matter or problem regarding the use of the Card at the respective terminal.

9. CARD IS THE PROPERTY OF AEON CREDIT

9.1. The Card is and shall at all times remain the property of AEON

Credit and shall be surrendered to AEON Credit immediately upon request by AEON Credit or its duly authorised agent.

9.2. Upon the expiry of the Card, the Cardholder shall immediately surrender the expired Card to AEON Credit and request for the issuance of a new Card which shall be entirely at the absolute discretion of AEON Credit whether to do so.

10. CARDHOLDERS’ RESPONSIBILITIES

The Cardholder shall:

(a) abide by the terms and conditions for the use of the Card;

(b) take reasonable steps to keep the Card, PIN and security details secure at all times, including at the Cardholder's place of residence. These include not:

(i) disclosing the Card details or PIN to any other person (including persons in apparent authority, family members or spouse);

(ii) writing down the PIN or security details on the Card, or on anything kept in close proximity with the Card;

(iii) Using a PIN selected from the Cardholder's birth date, identity card, passport, driving license or contact numbers; and

(iv) allowing any other person to have or use the Card and PIN.

(c) notify AEON Credit as soon as reasonably practicable after having discovered that the Card is lost, stolen, an unauthorised transaction had occurred or the PIN may have been compromised;

(d) notify AEON Credit immediately upon receiving short message service (SMS) transaction alert if the transaction was unauthorised;

(e) notify AEON Credit immediately of any change in the Cardholder's contact number;

(f) use the Card responsibly, including not using the Card for unlawful activity; and

(g) check the account statement and report any discrepancy without undue delay.

11. DISCLOSURE OF PIN, OR LOSS, THEFT OR UNAUTHORISED USE OF CARD

11.1. The disclosure of the PIN to any unauthorised person, or loss, theft or unauthorised use of the Card shall immediately be reported by phone call or fax to AEON Credit, followed by a written letter to AEON Credit. The Cardholder shall also immediately lodge a detailed and accurate police report upon the occurrence of such event and deliver a copy of the relevant police report to AEON Credit promptly and in any case no later than seven (7) days from the happening of such event unless the Cardholder is overseas. Upon receipt by AEON Credit of a verbal or written notice, an investigation will be carried out. Cardholders who are not satisfied with the investigation report, may seek redress for disputes against AEON Credit and Cardholders can refer eligible disputes to Ombudsman for Financial Services (OFS). Further information on eligible disputes covered by the financial ombudsman scheme and procedures for bringing a dispute to the financial ombudsman scheme is available on the Ombudsman for Financial Services’ website at www.ofs.org.my

11.2. Subject to Clause 14, until and unless a verbal or written notice of loss or theft of the Card from the Cardholder in accordance with Clause

11.1 has been received by AEON Credit, the Cardholder shall remain liable for all the charges incurred prior thereto whether or not use of the Card was authorized by the Cardholder.

11.3. Although AEON Credit is under no obligation to issue a replacement card, AEON Credit may do so subject to payment of such fee as may be prescribed by AEON Credit.

11.4. Any replacement Card will be subject to a card replacement fee of Ringgit Malaysia Twelve (RM12.00) deducted from the Cardholder’s Prepaid Card Account Stored Value or such other rate as AEON Credit may prescribe at its absolute discretion. The remaining balance from the previous card may be transferred to the replaced Card unless the Card is cancelled.

11.5. Upon receipt of written notification from the Cardholder of such loss or theft or misuse of the Card, AEON Credit shall refund in any manner it deems fit to the Cardholder the Prepayment or any part of it unused or remaining thereof in the Cardholder’s Account less all monies due from the Cardholder to AEON Credit under the terms of this Agreement and AEON Credit shall not be liable to pay any interest on the Prepayment or the amount remaining in the Cardholder’s Account to the Cardholder.

12. DISPUTES

12.1. All disputes arising from the Cardholder’s Statement shall be made or notified to AEON Credit within fourteen (14) days from the date of the Statement to the Customer Care Centre as set out in Clause 24.3 herein, followed by submission of the relevant form on disputed transaction(s), duly completed. Notwithstanding anything herein to the contrary, the Cardholder shall be deemed to have conclusively accepted all charges on the Statement if the same are not disputed within the said period of fourteen (14) days.

12.2. In the event that the Cardholder disputes any transactions pursuant to Clause 12.1 hereof, AEON Credit may in its absolute discretion conduct any investigation(s) regarding the disputed transaction(s)wherein the following shall apply:

12.3. If AEON Credit’s investigation(s) reveal or indicate that the Cardholder is liable for any of the disputed transaction(s),AEON Credit shall be entitled to levy the following charges:

· sales draft retrieval fee of Ringgit Malaysia Fifteen (RM15.00) or any other amount which

AEON Credit may determine from time to time; and

· no sale draft retrieval fee shall be levied in the event that the investigation(s) reveal that the Cardholder is no t liable for any of the disputed transaction(s).

12.4. AEON Credit’s findings in any investigation conducted in relation to the Credit Card Account shall be conclusive, final and binding on the Cardholder

13. CARD SHALL NOT BE USED FOR UNLAWFUL ACTIVITIES

13.1. The Card shall not be used for any unlawful activities such as illegal online banking, betting or gambling.

13.2. AEON Credit shall immediately terminate the prepaid card facility if the Cardholder is found to have used the prepaid card for an unlawful activity.

13.3. The Card is not transferable and AEON Credit shall not, in any circumstances be liable for any unauthorised or unlawful purchase transaction or withdrawal of cash through the use or production of the Card by any unauthorised person. AEON Credit is not under any obligation to verify the identity or the authority of any person using the Card and AEON Credit shall not be liable for acting in good faith for honoring the purchase transaction or withdrawal of cash which are performed by the authorised or unauthorised person through the use or production of the Card, regardless of the circumstances prevailing at the time when such purchase transaction or cash withdrawal is being carried out. All purchase transactions or cash withdrawals shall be deemed by AEON Credit to have been made by the Cardholder and the Cardholder shall be liable for all charges whatsoever and howsoever arising from these purchase transactions or cash withdrawals, subject to prevailing regulations.

13.4. The merchant who provides the goods and/or services shall also not be held liable for the unauthorised or unlawful purchase transaction through the use or production of the Card and shall be entitled to deal with the holder of the Card and shall be under no obligation to verify the identity of the holder PROVIDED THAT the Merchant shall not honor the Card if the Merchant has been notified by AEON Credit not to honor such Card.

13.5. The terms and conditions and the availability of the Card shall, where applicable, be subject to Anti - Money Laundering, Anti - Terrorism. Financing and Proceeds of Unlawful Activities Act 2001 (“AMLATFPUAA”) and all rules, regulations and guidelines of Bank Negara Malaysia and any other relevant bodies irrespective such rules, regulations and guidelines do not have the force of law. AEON Credit may at its own discretion delay, block or refuse to make a transaction if AEON Credit believes on reasonable grounds that making the transaction may breach any of the laws of Malaysia or any other country and AEON Credit will incur no liability to the Cardholder if AEON Credit does so. The Cardholder agrees to release AEON Credit from all liability and to indemnify and hold AEON Credit harmless from any loss or damage that the Cardholder may suffer as a consequence.

13.6. The Cardholder shall ensure that the transactions to be effected using the Card(s) and monies or funds to be used for “top - up”/ reload of the Card(s) are neither obtained from any unlawful source nor relate to any unlawful activities as specified under AMLATFPUAA.

13.7. The Cardholder acknowledges that AEON Credit may have to act promptly and on limited information if there is suspicion of fraud, money laundering or other illegal activity.

14. LIABILITY FOR UNAUTHORISED TRANSACTION

Without prejudice to the rights of AEON Credit herein and notwithstanding that the Cardholder may have exercised all reasonable precautions and diligence to prevent the loss or theft of the Card and reported the loss or theft in accordance with Clause 11.1 hereof, the Cardholder shall remain liable to pay to AEON Credit in the following circumstances:

14.1. Cardholder shall be liable for PIN - based unauthorised transactions if Cardholder has:

(i) acted fraudulently; or

(ii) delayed in notifying AEON Credit as soon as reasonably practicable in accordance to Clause 11.1 after having discovered the loss or unauthorised use of the Card; or

(iii) voluntarily disclosed his/her PIN to another person, or recorded the PIN on the Card, or on anything kept in close proximity with the Card.

14.2. Cardholder shall be liable for any unauthorised transactions which require signature verification, PIN verification or with a contactless card, if Cardholder has:

(i) acted fraudulently; or

(ii) delayed in notifying AEON Credit as soon as reasonably practicable in accordance to Clause 11.1 after having discovered the loss or unauthorised use of the Card;or

(iii) left the Card or item containing the Card unattended in places visible and accessible to other; or

(iv) voluntarily allowed another person to use the Card.

15. DEFECTIVE CARD

In the event that the chip or the magnetic strip on the Card is faulty or damaged or defective at any time:

(i) and through no fault of the Cardholder, AEON Credit may replace the Card free of charge;

(ii) due to the fault of the Cardholder, AEON Credit may at the request of the Cardholder replace the Card for a fee of Ringgit Malaysia Twelve (RM12.00) per Card or such other rate as maybe prescribed by AEON Credit from time to time, and which sum shall be debited to Cardholders’ Prepaid Card Account.

16. CONCLUSIVE EVIDENCE

16.1. The Cardholder may check with AEON Credit customer service, AEON Credit website or alternatively from AEON Credit’s ATMs that display the Visa and PLUS logos the Stored Value of the Prepayment in the Cardholder’s Prepaid Card Account at any time and from time to time. However, the amounts reflected on the ATM screen against the Cardholder’s

Prepaid Card Account shall not for any purpose whatsoever be taken as a conclusive Stored Value statement of the Cardholder’s Prepaid Card Account with AEON Credit as it shall not include Prepayment to the Cardholder’s Prepaid Card Account which have not been verified by AEON Credit.

16.2. The Cardholder may access Cardholder’s AEON Member Plus Visa Card Account statement online (“e - statement”) free of charge via AEON Credit’s website by logging into Cardholder’s account with their username and password.

16.3. The Online Statement will provide transactions history including fees and charges for the past Twelve (12) months, except for transactions not yet processed by AEON Credit.

16.4. The Cardholder shall inform AEON Credit of any errors within Fourteen (14) days from the date Transactions are posted to the Online Statement failing which the Cardholder shall be deemed to have accepted the entries contained in the Online Statement as correct and as final and conclusive evidence of the facts contained therein and binding on the Cardholder and the Cardholder shall thereafter be precluded from making any claims against AEON Credit by alleging that its said statement contains error, discrepancy or inaccuracy.

16.5. The Cardholder may request AEON Credit for a printed statement of account detailing

the purchase transactions for the Card up to a period of Three (3) months and AEON Credit shall be entitled to charge a fee of Ringgit Malaysia Five (RM5.00) only per statement or at such other rate as may be prescribed by AEON Credit from time to time and such fee may be debited by AEON Credit directly from the Stored Value of the Prepayment in the Cardholder’s Prepaid Card Account. All information contained in such statements issued by AEON Credit shall be deemed to be accurate, conclusive and binding on the Cardholder unless the Cardholder notifies AEON Credit otherwise in writing within Fourteen (14) Business Days of the date of receipt of such statements. For avoidance of doubt, such statement of account shall be deemed to have been duly received by the Cardholder within 48 hours from the date of posting.

16.6. The Cardholder may request for copies of the sales draft subject always to their availability and AEON Credit shall be entitled to charge a fee of Ringgit Malaysia Fifteen (RM15.00) only per sales draft or at such other fee as AEON Credit shall in its absolute discretion prescribe, for each copy and such fee may be debited by AEON Credit directly from the Stored Value of the Prepayment in the Cardholder’s Prepaid Card Account.

16.7. Cardholder may request AEON Credit to courier printed statement of account or sales draft within Malaysia only and AEON Credit shall be entitled to charge a postage fee deducted directly from the Stored Value of the Prepayment in the Cardholder’s Prepaid Card Account.

17. AEON CREDIT’S RIGHTS TO CHARGE FEES AND/OR CHARGES

17.1. Immediately upon a demand being made by AEON Credit, the Cardholder shall pay AEON Credit the following:

(i) Annual fee of Ringgit Malaysia Twelve (RM12.00) upon issuance of the Card and annually from the month of issuance;

(ii) Withdrawal fee upon cash withdrawal by the Cardholder through Visa PLUS Network;

(iii) Card replacement fee upon Card replacement requested by the Cardholder;

(iv) Sales draft retrieval fee for dispute raised but found to be invalid;

(v) Hardcopy statement fee upon hardcopy statement requested by the Cardholder;

17.2. All fees paid pursuant to or in connection with the Card are non-refundable under any circumstances whatsoever.

17.3. All fees, rates, taxes or charges may be varied at any time and from time to time at the sole and absolute discretion of AEON Credit by giving the Cardholder a twenty-one (21) calendar days’ notice in advance.

17.4. In consideration of next annual fee payment, the Cardholder expressly agree for AEON Credit to make deduction from the Card balance and/or AEON Points balance. The Cardholder must ensure that sufficient balance is in the Card to cover for annual fee. AEON Points balance will be deducted automatically in full or in partial for the annual fee payment if there is insufficient balance available in the Card. Failure obligation to make annual fee payment to AEON Credit, the member function in the Card shall be temporarily disabled.

18. PREPAYMENT AND TOP-UP

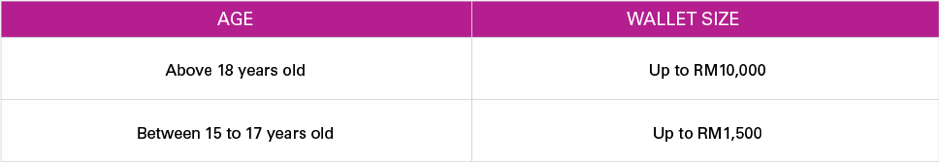

18.1. Prepayment which is subject to the card limit of Ringgit Malaysia Ten Thousand (RM10,000) or Ringgit Malaysia One Thousand Five Hundred (RM1,500.00) (whichever applicable) less any current balance may be made or deposited by the Cardholder into the Cardholder’s Prepaid Card Account via:

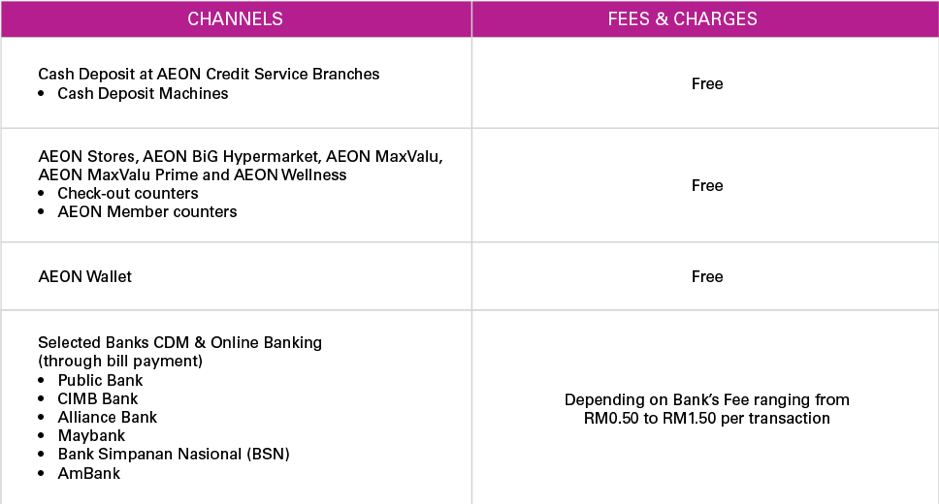

(i) cash deposit machines maintained at any of AEON Credit branches, free of charge; or

(ii) cash deposit machines or online banking maintained by other banks, subject to service charge ranging from Ringgit Malaysia Fifty Cents (RM0.50) to Ringgit Malaysia One and Fifty Cent (RM1.50) imposed by the other banks; or

(iii) AEON Wallet

(iv) other channels which will be made available from time to time.

18.2. Prepayment made other than via AEON Credit’s channel as stated in Clause 18.1 above shall be subjected to a service charge based on the rate depending on the agent, shall be charged on the Cardholder for each and every reload of the Prepayment into the Cardholder’s Prepaid Card Account and such fee may be debited directly from the Stored Value of the Prepayment in the Cardholder’s Prepaid Card Account or surcharge on top of the reload amount.

18.3. Top up by the Cardholder shall not be considered to have been made until the relevant top up has been received for value by AEON Credit.

18.4. The Cardholder hereby agrees that neither refund nor cancellation is allowed once prepayment is made into the Cardholder’s Prepaid Card Account.

18.5. The maximum Stored Value that the Cardholder may credit to the Card is Ringgit Malaysia Ten Thousand (RM10,000), Ringgit Malaysia One Thousand Five Hundred (RM1,500.00) for Minor or any amount as may be determined by AEON Credit. Nevertheless if as a result of any error or other circumstances, AEON Credit’s system permits the Cardholder’s Stored Value to exceed Ringgit Malaysia Ten Thousand (RM10,000), Ringgit Malaysia One Thousand Five Hundred (RM1,500.00) for Minor or any amount as may be determined by AEON Credit, AEON Credit will notify the Cardholder of such excess and require the Cardholder to fully utilize such excess within Fourteen (14)days from the date of AEON Credit’s notification. Cardholder may request AEON Credit to refund the excess Stored Value and AEON Credit shall perform the refund through interbank fund transfer to the Cardholder. Cardholder who does not have local bank account for refund via bank transfer, as well as account holder who are un-contactable to obtain bank supporting document within 30 days for prepaid card from the cancellation, and Cardholder who refuse to provide bank supporting document may request for cheque issuance from any AEON Credit branches or request AEON Credit to post the cheque to Cardholder’s registered address.

18.6. Without prejudice to any of the provisions of this Agreement, the Cardholder agrees not to hold AEON Credit liable at any time in the event it is unable to perform its obligations under this Agreement due (directly or indirectly) to the failure of any machine, data processing system or transmission link or industrial dispute or any factor beyond AEON Credit’s control.

19. CARD TERMINATION BY CARDHOLDER

19.1. The Cardholder may at any time after acceptance and/or usage of the Card, terminate the use of the Card by notifying or a written notice to AEON Credit at the Customer Care Centre as set out in Clause 24.3 herein or nearest branch of AEON Credit. Upon termination of the use of the Card, the Cardholder shall cut the Card, cut across the magnetic stripe and across the chip. Upon AEON Credit’s receipt of notice from the Cardholder, AEON Credit shall immediately cancel the usage of the Card and may refund in any manner it deems fit the balance of the Prepayment in the Cardholder’s Prepaid Card Account to the Cardholder after deducting all monies due from the Cardholder to AEON Credit under the terms of this agreement and AEON Credit shall not be liable to pay any interest on the Prepayment or the amount remaining in the Cardholder’s Prepaid Card Account to the Cardholder within Thirty (30) Calendar Days.

19.2. Subject to Clause 19.3 below, the Card shall be valid for a period of Four (4) years from the date of the card embossed or until such time as the Card is cancelled by AEON Credit at any time in its sole discretion, whichever is earlier, for the following reasons:

(a) any money is owing by the Cardholder to AEON Credit under the terms of this agreement due to any reason whatsoever for more than Fourteen (14) Business Days or such other period as may be determined by AEON Credit from time to time; or

(b) the Card is used for any transaction which is not authorised by AEON Credit; or

(c) the Card is reported lost, misplaced or stolen.

19.3. In amplification and not derogation of Clause 5.3 hereof, the Card shall be terminated by AEON Credit without notice upon the death, bankruptcy or insolvency of the Cardholder.

19.4. Cardholder is aware that the AEON Points shall be forfeited upon Card termination.

19.5. The Stored Value will be refunded to Cardholder either through cheque issuance or through interbank fund transfer to the Cardholder. Cardholder may collect the cheque from any AEON Credit branches or request AEON Credit to post the cheque to Cardholder’s registered address.

20. FEATURES AND BENEFITS RENEWABLES

20.1. AEON Credit may review and revise any of the features and benefits listed in the Directory from time to time.

21. UNCLAIMED MONEYS ACT 1965

21.1. Cardholder is aware of the provisions of the Unclaimed Moneys Act 1965, wherein the Cardholder’s Prepaid Card Account balance will be classified as unclaimed money Two (2) years from the date of the last transaction initiated by the Cardholder, as such funds in the account are required to be transferred to the Registrar of Unclaimed Moneys (RUM).

21.2. Cardholder agrees to come to AEON Credit branches to perform a withdrawal or deposit transaction prior to the expiry of the Two (2) years in order to re-activate the Card.

21.3. If Cardholder fails to re-activate the Card, Cardholder is aware that AEON Credit shall give Cardholder Sixty (60) days advance notice before arranging to transfer the funds in the Card to the RUM. The AEON Points shall be forfeited.

22. VISA PAYWAVE

22.1. Cardholder may utilize Visa payWave innovative and convenient payment option at selected Merchants where Visa payWave readers are available.

22.2. Cardholder is not required to key in their PIN for any retail transaction on the Cardholder’s Prepaid Card Account not exceeding Ringgit Malaysia Two Hundred Fifty (RM250.00).

22.3. When prompted, Cardholder is required to key in their PIN for any retail transaction on the Cardholder’s Prepaid Card Account exceeding Ringgit Malaysia Two Hundred Fifty (RM250.00) or total cumulative retail transaction value exceeds Ringgit Malaysia Four Hundred (RM400).

22.4. To promote confidence in the use of contactless prepaid cards, Cardholder will have the options to set a cumulative transaction limit for contactless transactions via AEON Credit website. Whenever Cardholder reached the determined cumulative contactless transaction limit, Cardholder will be prompted to complete the settlement by keying in PIN into terminal. The cumulative contactless transaction will be reset to the determined amount after every successful contact settlement.

22.5. Cardholder also has an option to disable the payWave function which can be done via AEON Credit website.

22.6. The Cardholder acknowledges and agrees that the use of the performance of Contactless Transaction is at the risk of the Cardholder. All Contactless Transaction will be deemed to have properly authorized by the Cardholder unless the Cardholder can show conclusive proof of the contrary.

23. VARIATION REVISION OR CHANGE OF TERMS AND CONDITIONS

23.1. AEON Credit may from time to time by giving written notice to the Cardholder of at least Twenty One (21) calendar days in advance, vary, revise or change the terms and conditions. Such variation, revision or change shall apply on the effective date specified by AEON Credit.

23.2. Notice of additions or amendments may be effected by:-

(a) mailing the notice to the Cardholder, or

(b) sending the notice by e-mail to the Cardholder, or

(c) sending the notice by SMS to the Cardholder

23.3. Retention or use of the Card after the effective date of any variation, revision or change of terms and conditions pursuant to Clause 24.1 and Clause 24.2 hereof shall be deemed to constitute acceptance of such variation, revision or change without reservation by the Cardholder.

23.4. If the Cardholder does not accept the proposed variation, revision or change, the Cardholder must terminate the use of the Card by giving prior written notice to AEON Credit and return the Card, cut across the magnetic stripe and across the chip, to AEON Credit prior to the effective date and the use of the Card thereafter shall be deemed terminated upon AEON Credit’s receipt of the Card cut across the magnetic stripe and across the chip and the provision relating to termination in Clause 19 hereof shall henceforth apply.

24. AEON CREDIT’S RIGHT TO DISCLOSE

24.1. The Cardholder consents to the disclosure of the last known address of the Cardholder to any bank or VISA International or its successors and

24.2. The disclosure of the Card numbers of any new, renewed or replaced Card to merchants or other interested persons.

24.3. AEON Credit shall be entitled to disclose and the Cardholder consents to the disclosure by AEON Credit of any information pertaining to the Cardholder and/ or the Prepaid Card Account to such extent as AEON Credit may at its sole and absolute discretion deem fit to the Central Credit Reference Information System under Bank Negara Malaysia, credit information organisations and/or other authority or body established by Bank Negara Malaysia, any other authority having jurisdiction over AEON Credit, AEON Credit’s branches, related corporations, associates, subsidiaries, affiliates, assignees, proposed assignees, agents and/or another parties engaged by AEON Credit to enable or assist AEON Credit to exercise or enforce AEON Credit’s rights hereunder and/or any other party whomsoever as AEON Credit may, at its sole and absolute discretion deem fit. The Cardholder will be given the option to “opt-in” or “opt-out” on the disclosure of information for cross-selling, marketing and promotional purposes. If at any time, the Cardholder wishes to have his/her name and address removed from such marketing communication, the Cardholder is required to write to AEON Credit Service (M) Berhad, Level 18, UOA Corporate Tower, Avenue 10, The Vertical, Bangsar South City, No. 8 Jalan Kerinchi, 59200 Kuala Lumpur or call our Customer Care Centre at 03-2719 9999 for more details.

24.4. Any consented disclosure by AEON Credit of the information referred to in this Clause will not render AEON Credit liable to the Cardholder for any claim, loss, damage (including direct or indirect damages or loss of profits or savings) or liability howsoever arising whether in contract, negligence, or any other basis arising from or in relation to:

(i) the release or disclosure of the information by AEON Credit; and/or

(ii) the information being incorrect, erroneous or misstated; and/or

(iii) reliance on the information, whether caused by AEON Credit or other third party’s omission, misstatement, negligence or default or by technical, hardware or software failures of any kind, interruption, error, omission, viruses, delay in updating or notifying any changes in the information or otherwise howsoever.

25. RETAIL PURCHASES MADE OUTSIDE MALAYSIA

25.1. If transaction is made outside Malaysia in foreign currency, the transaction wiII convert into a Ringgit Malaysia equivalent at the conversion rate as determined by VISA as at the date it is processed by VISA.

25.2. In addition, Cardholder will also pay service charge of one per centum (1%) for the conversion of the transactions made in foreign currencies.

25.3. Cardholder agree that in the event of any dispute on the conversion rates determined by VISA on any transactions Cardholder have made outside Malaysia, AEON Credit will not be responsible to settle such disputes on Cardholders behalf with VISA.

26. INTERNET TRANSACTIONS

If Cardholder uses the Card to purchase goods and/or services through the online internet sites or portals, Cardholder shall be solely responsible for the security of such use at all times. Cardholder agrees that the entry of the Card information on the internet shall be sufficient proof of the authenticity of such instructions, subject to input and system verification of One-Time Password (OTP) sent to your mobile phone number registered with AEON Credit for transactions at 3-D Secure merchant websites. AEON Credit shall not be under any obligation to verify the identity or the authority of the person entering the Cardholder's Card information and AEON Credit shalI not be liable for acting on such use of the Card information regardless of whether the person is so authorized and regardless of the circumstances prevailing at the time of transaction. However, AEON Credit reserves the discretion to not carry out any such transaction over the internet if AEON Credit has any reason to doubt its authenticity or if in AEON Credit's opinion it is unlawful or otherwise improper to do so for any other reason.

27. GOVERNING LAW AND JURISDICTION

This Agreement between AEON Credit Service and the Cardholder shall be governed by the laws of Malaysia regardless of where the transaction itself takes place.

28. COSTS AND EXPENSES

The Cardholder shall be liable to pay to AEON Credit all legal costs (including costs on a solicitor and client basis), charges and expenses which AEON Credit may incur in enforcing or seeking to enforce any of the provisions herein or in obtaining or seeking to obtain payment of all or any part of the monies owing by the Cardholder.

29. EXECUTION OF FURTHER DOCUMENTS

The Cardholder undertakes to sign such further documents as may be requested by AEON Credit from time to time.

30. NOTIFICATION OF CHANGE

The Cardholder shall promptly notify AEON Credit in writing, via e-mail or phone call of any change in his employment or business, address (office or residential) or telephone number(s) or if the Cardholder intends to be absent from Malaysia for more than Thirty (30) days. Notification of change(s) may be made by completing the “Change of Personal Details” form online at www.aeoncredit.com.my, by email to customer.service@aeoncredit.com.my, by calling AEON Credit Customer Care Centre at 03-2719 9999 or by writing in to AEON Credit Service (M) Berhad, Level 18, UOA Corporate Tower, Avenue 10, The Vertical, Bangsar South City, No. 8 Jalan Kerinchi, 59200 Kuala Lumpur.

31. FEATURES AND BENEFITS RENEWABLE

AEON Credit may review and revise any of the features and benefits listed in the Directory from time to time.

32. INDEMNITY

The Cardholder shall hold AEON Credit harmless and indemnify AEON Credit against any liability for loss, damage, costs and expenses (legal or otherwise including costs on a solicitor and client basis) which AEON Credit may incur by reason of the provisions herein or in the enforcement of its rights hereunder.

33. AEON CREDIT’S RIGHT TO WITHDRAW ANY FACILITIES OR TERMINATE THE USE OF CARD

33.1. AEON Credit reserves the right to withdraw all or any of the Prepaid Card Facilities provided at any time by giving notice with reason(s) to the Cardholder and in such circumstances if it so deems fit to terminate use of the Card notwithstanding that AEON Credit may have waived its rights on some previous occasions

33.2. In addition to the provisions herein the Cardholder hereby agrees and confirms that all fees and charges payable by the Cardholder under the terms and conditions herein may be debited by AEON Credit directly from the Stored Value of the Prepayments in the Cardholder’s Prepaid Card Account and are non-refundable.

34. SERVICE AND NOTIFICATION

34.1. The Cardholder hereby irrevocably consents to the service of any notice or statement hereunder by prepaid ordinary post to the last known address of the Cardholder in AEON Credit's records and such service shall be deemed effective on the seventh (7th) day after posting. Notice may also be given to the Cardholder via e-mail and shall be deemed served upon confirmation of delivery.

34.2. The Cardholder hereby agrees that in the event that any action is begun in the Malaysian Courts in respect of this Agreement, the legal process and other documents may be served by posting the documents to the Cardholder at the last known address of the Cardholder in AEON Credit's records and such service shall on the seventh (7th) day after posting, be deemed to be good and sufficient service of such process or documents.

35. ASSIGNMENT

AEON Credit shall be entitled at any time without the consent of the Cardholder to assign the whole or any part of its rights or obligations hereunder with or without notice to the Cardholder.

36. SUCCESSORS BOUND

This Agreement shall be binding upon and enure to the benefit of the respective successors in title and assigns of the Cardholder and AEON Credit provided that the Cardholder may not assign its rights and obligations hereunder.

37. SEVERABILITY OF PROVISIONS

If any of the provisions herein becomes invalid, illegal or unenforceable in any respect under any law the validity, legality and enforceability of the remaining provisions shall not in any way be affected or impaired.

38. AEON POINTS

38.1. AEON Points Programme is a programme for Cardholders of AEON Member Plus Visa Card issued by AEON Credit Service (M) Berhad.

38.2. AEON Points are awarded to the Cardholder based on the total posted Ringgit Malaysia (RM) amount of eligible purchases within and outside Malaysia charged to the Card.

38.3. The AEON Points will be credited into Cardholder’s account within 48 hours after the transaction is completed.

38.4. The AEON Points earned are valid for up to three (3) years period (based on statement date).

Example: AEON Points earned between Statement dates from January 2018 to December 2018 is considered as AEON Points earned in year 2018 and will therefore expire on 31st December 2021.

38.5. The applicable expiry dates for Points earned will be shown in the Cardholder’s Statement and AEON Points earned but not redeemed will be forfeited on the expiry dates.

38.6. For Cardholder who opts for Auto Conversion method, AEON Points will be converted to cash value in the AEON Member Plus Visa Card on the monthly statement date.

38.7. For Cardholder who opts for Manual Conversion method, the AEON Points rewarded by AEON Credit shall be accumulated in the AEON Member Plus Visa Card’s Account and to be converted to cash value into AEON Member Plus Visa Card after the Member performs the redemption via www.aeoncredit.com.my, AEON Wallet or any other medium which will be made available from time to time.

39. TIME OF ESSENCE

39.1. Time shall be of the essence hereof.

39.2. No failure to exercise and no delay in exercising on the part of AEON Credit of any right, power or privilege hereunder shall operate as waiver thereof, nor shall any single or partial exercise of any right, power or privilege preclude any other or further exercise thereof or the exercise of any other right, power or privilege.

39.3. The rights and remedies herein provided are cumulative and not exclusive of any rights or remedies provided by law.

40. CONFLICT BETWEEN ENGLISH TEXT AND OTHERS

In the event of any conflict or discrepancy between the English text of terms and conditions herein and any translation thereof, the English text shall prevail.

41. PUBLICATION OF THIS TERMS AND CONDITIONS ON AEON CREDIT’S WEBSITE

41.1. A copy of this Terms and Conditions is published at our website www.aeoncredit.com.my. In the event AEON Credit changes or varies any terms and conditions herein, the amended and updated version will be posted on the aforesaid website.

41.2. In the event of any queries relating to these terms and conditions, the Cardholder may contact AEON Credit’s Customer Care Centre at the following address, e-mail address, telephone and facsimile numbers (or such address, e-mail address, telephone and facsimile numbers which AEON Credit may change by notification to the Cardholder) through Customer Care Centre, Tel: 603-27199999, Fax: 603-78637898, E-mail: customer.service@aeoncredit.com.my ,Website: www.aeoncredit.com.my.

42. FORCE MAJEURE

Without prejudice to any of the provision of this Agreement, the Cardholder agrees not to hold AEON Credit liable in the event that AEON Credit is unable to perform in whole or in part any of its obligations under this Agreement, attributable directly or indirectly to the failure of any mechanical or electronic device, data processing system, transmission line, electrical failure, industrial dispute, any act beyond AEON Credit’s control or due to any factor in a nature of a force majeure